Rent vs. Buy: How to Decide What’s Best for You

Stephanie Danielson

Rents continue to rise making home buying a great option!

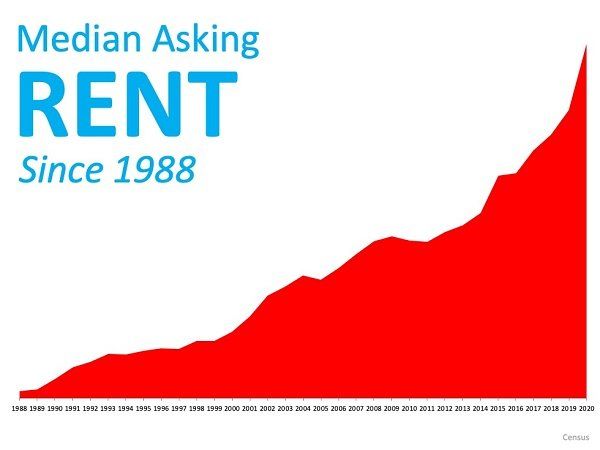

According to the U.S. Census Bureau, median rent

continues to rise. With today’s low mortgage rates, there’s great opportunity for current renters to make a move into homeownership that stretches each dollar a little bit further.

While the best timeline to buy a home is different for everyone, the question remains: Should I continue renting or is it time for me to buy? The answer depends on your current situation and your future plans, so here are some thoughts to help you decide if you’re ready to own a home of your own.

1. Rent Will Continue to Increase

This is one of the top reasons why renters decide to move because in most cases, rent will continue increasing each year. As noted above, the U.S. Census Bureau recently released its quarterly homeownership report,

and as the graph below shows, median rent

is climbing year after year. When you own a home, you’ll lock in your monthly payment for the life of your loan, creating consistency and predictability in your payments.

2. Freedom to Customize

This is a big decision-making point for many people who want to be able to paint, renovate, and make home upgrades. In many cases, landlords determine all of these selections and prefer you do not alter them as a renter. As a homeowner, you have the freedom to decorate and personalize your home to truly make it your own.

3. Privacy

When renting, your landlord has access to your space in case of an emergency. If you own your home, however, you’re the one to decide who can come inside. Given today’s health concerns around the pandemic, this may be a growing priority for you.

4. Flexibility for Relocation

If you’re renting, it may be easier to move quickly should you have a job transfer or simply decide it’s time for a change. When you’re a homeowner and need to sell your house, this might take a little more time. Today, however, with the housing market’s low inventory, this may no longer be the case. Homes are selling at a record-breaking pace, so you may have more flexibility than you think.

5. Building Equity

When you pay your rent, your landlord earns the equity the property gains. If you own your home, the benefits of your investment go directly toward your net worth. This is savings you’ll be able to use in the future for things like sending children to college, starting a new business, buying a bigger home, or simply downsizing to save for retirement.

6. Tax Advantages

When you own your home, there are additional advantages that work in your favor as well. You can deduct things like your property taxes and mortgage interest (Always make sure you check with your accountant to see which tax-deductible benefits apply to your situation). When you rent, however, the tax benefits are directed to your landlord.

Bottom Line

It’s up to you to decide if you’d prefer to rent or buy, and it’s different for every person. If you’d like to learn more about the pros and cons of each, as well as resources to help you along the way, let’s connect to discuss your options. This way, you can make a confident and informed decision with a trusted expert on your side.

If you are thinking of buying, selling, renting your home, or leasing real estate this year we’d love to hear from you! Working with experienced professionals can boost your profits!

Acuity Group

564 Dodge Ave. Suite A

Elk River, MN 55330

763-633-3535

OUR SPECIALTIES: Residential & Commercial Seller and Buyer Services, Property Management & Residential Rentals, Association Management, Residential and Commercial Investment Property Specialists, New Construction, Listing & Marketing Specialists, CDPE (Certified Distressed Property Experts), Short Sale Specialists, REO/Bank Owned Sales. Golf course properties, water front properties, acreage & hobby farms, vacant land, condos & townhomes, industrial/manufacturing/retail properties, association maintained properties, senior housing, luxury homes, vacation & secondary housing.

Serving the following Minnesota Counties: Sherburne, Anoka, Wright, Hennepin and portions of Mille Lacs and Isanti Counties

Contact Us

You’re probably feeling the impact of high inflation every day as prices have gone up on groceries, gas, and more. If you’re a renter, you’re likely experiencing it a lot as your rent continues to rise. Between all of those elevated costs and uncertainty about a potential recession, you may be wondering if it still makes sense to buy a home today. The short answer is – it does. Here’s why.

When we say ‘commercial real estate, simplified’ we mean it. Buying, selling, or leasing commercial property can feel stressful and even overwhelming. You want to know that you have an experienced and trusted Commercial Real Estate Brokerage on your side, working to help you achieve your goals! Serving Elk River, MN and surrounding communities since 2008.

If you put your plans on pause because of intense bidding wars in recent years, it may be time to kick off your home search. Today, bidding wars are easing and that may mean less competition for you as a buyer. If you’re serious about buying a home or making a move, let’s connect to get started today!

Whether you’ve just retired or you’re thinking about retirement, you may be considering your options and trying to picture a whole new stage of your life. And you’re not alone. Research from the Retirement Industry Trust Association (RITA) shows 10,000 Baby Boomers reach the typical retirement age (65) every day, and only 47% of the people in that generation have already retired.